Delivered by Ingenta, Wed, 13 Feb 2019 17:54:33

Copyright: Henry Stewart Publications

© Henry Stewart Publications 2054-7544 (2017) Vol. 3, 2 139–145 Applied Marketing Analytics 139

Received (in revised form): 7th June, 2017

Jacques Bughin

Jacques Bughin is a senior partner at McKinsey & Company where his work focuses on high-tech, telecom and media industries. He is a director of the McKinsey Global Institute and a Fellow of ECARES and the University of Leuven. He is the co-author of ‘Managing Media Companies’ (Wiley & Sons), and his academic articles have been published in such journals as the European Economic Review, Management Science, Journal of Economic Behavior and Organization and Journal of Big Data.

E-mail: jacques_bughin@mckinsey.com

Gloria Macias-Lizaso

Gloria Macias-Lizaso is a partner at McKinsey & Company, where she focuses on telecom, banking and retail. She leads the McKinsey Center of Excellence for Machine Learning in Europe, supporting clients across industries and geographies on how to improve their performance through advanced analytics.

E-mail: gloria_macias@mckinsey.com

Abstract Contrary to popular belief, companies are not suffering from a lack of data but a lack of institutional capabilities to transform data into higher profits. To secure the greatest returns from a company’s data requires analytic transformation — this paper describes the key elements.

KEYWORDS: Big Data, machine learning, analytics, analytic transformation

INTRODUCTION

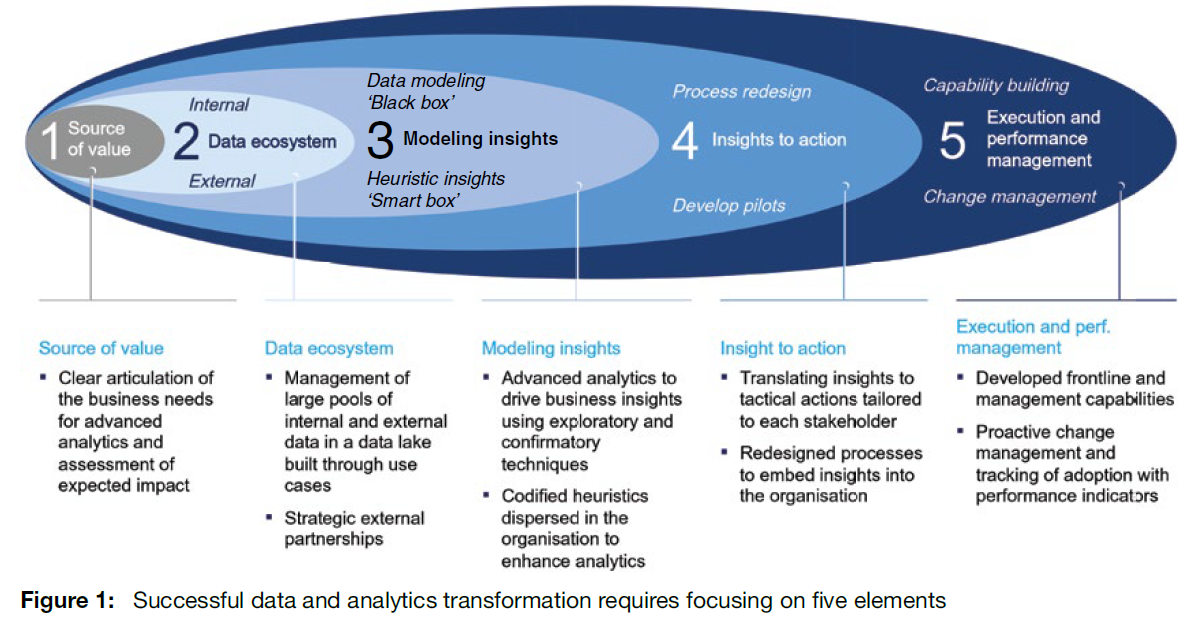

‘Big Data’ and ‘advanced analytics’ are buzzwords in today’s business world. However, one in three companies struggle to get any bang for their buck in this area.1 Experience suggests this is due to two main reasons: few companies appreciate what Big Data means for their business, and even fewer understand how to translate that into higher profits. Obtaining significant returns from Big Data requires an integrated process of analytic transformation.2,3 This process requires five elements: understanding the sources of value; collecting all relevant data; applying the latest modelling techniques; integrating insights into the workflow; and building management capabilities to evaluate the process and manage change (Figure 1). Ultimately, the real power of Big Data comes from using advanced analytics on large and diverse data sets for prediction not explanation. This paper draws on the authors’ research and experience to explain how companies can profit from their data assets. It highlights several case studies that reveal how Big Data can create value throughout the business value chain and identifies the steps that successful companies typically take to achieve analytic transformation. Finally, it outlines what companies can do right now to get started.

EXAMPLES FROM SALES AND MARKETING ANALYTICS

Advanced analytics has the potential to fundamentally change the way businesses operate in almost any industry. In what follows, several (anonymised) real-life sales and marketing examples are provided.

Insurance An insurance company can use advanced analytics for a large array of applications. It can better filter and price its customers during the underwriting process. It can optimise its distribution and agent network based on area potential and profiles. It can increase cross-selling opportunities while reducing undesired churn, improve claims management to reduce fraud, and improve efficiency.

While the list of opportunities is long, the important point is how to capture them. For example, one auto insurer found that it had six times more accident claims in the first 90 days of a customer lifetime than the average customer base. This was due to customers insuring after having had an accident. Inspecting customer vehicles prior to underwriting policies was too expensive a solution. Instead, the insurer analysed its internal data and complemented the information with available external data to identify which customers were more likely to report an accident in the first 90 days.

To benefit from this insight, the insurer changed its underwriting process to ask for additional information in applications and was thus able to change its decision-making process. If a customer was in the top four percentiles, the customer was automatically rejected. In percentiles 5–8, the customer was offered a very competitive price subject to an inspection of their vehicle (which had a limited cost as customers who had already had an accident refused to submit to in the inspection). These changes improved the loss ratio of the company by 8 per cent, allowing the insurer to offer more competitive pricing, thus helping increase its market share.

Telecom A telecom company could apply advanced analytics to its pricing and promotion activities, point-of-sales footprint optimisation, collections, churn, migration and cross-selling. But it could also expand beyond traditional areas into optimising network deployment to improve customer experience.

For example, one telecom company was struggling with how to improve its network deployment in cities to provide a better experience to customers and reduce churn.

Typically, it had looked to optimise capacity in static micro-markets (finding more than 50 in one specific city) but customers moved around the city and therefore experienced network quality issues during their day. To improve this experience, the telecom company mapped the daily journeys of its customers for three weeks and found that specific clusters of customers moved in the same direction, such as business people from residential areas into the business district; students from university campuses to recreational areas; stay-at-home parents from residential areas into commercial areas; and so forth. Based on this clustering, the company was able to understand the real network quality each customer was experiencing. The company was then able to link this network quality number to the customer cluster value and correlate it to churn for that specific cluster. Based on this information, the company was able to re-prioritise its deployment of network capital expenditure (capex), investing more in its most valuable clusters and improving churn significantly.

An additional benefit was that the telecom company was able to reduce overall capex deployment by 30 per cent following the recognition that some additional investments would not yield sufficient return.

Banking A banking institution can use new analytic techniques for more accurate risk profiling during underwriting to create better earlywarning systems and improve collection processes. However, there is also the potential to use the data collected for compliance to generate revenues or optimise costs, for example by making AML processes more efficient.

Another important opportunity for banks is to identify ‘dormant’ customers. One bank found a large percentage of its customer base was not very active. Despite low levels of attrition (ie customers who cancelled accounts and left the bank), such ‘soft’ attrition was actually driving much more value loss. Hence, it was critical for the bank to identify these customers and retain them before they could become ‘dormant’.

At first, the bank based its approach on value evolution. However, this approach had too many false positives, so prior to taking action, it was important for the bank to separate which value reductions could be harmful from those that were not. Once that was identified, the bank used more than 300 variables to model and anticipate customer behaviour. The top risky customers identified by the model were further divided into 13 segments with different profiles that informed specific retention actions. For example, one of the clusters was young customers turning 21. Once the cluster was identified, the bank found that its account product for this group waived commissions until the age of 21, which meant that many of these customers left once they realised they had to start paying fees. To appeal to these customers, the bank developed a specific ‘bridge’ product with no fees until they used other products.

In another case, the bank identified customers leaving due to the pricing of consumer loans. To retain these customers, the bank developed a specific call centre campaign that offered discounted rates based on a better understanding of customer risk. This campaign achieved an acceptance rate of more than 75 per cent.

RetailA retailer can use advanced analytics to optimise its network footprint and store layout, as well as pricing, promotions and end-to-end revenue-generating activities. It can optimise the supply chain based on a much more accurate daily demand prediction by stock-keeping unit (SKU) and by stores.

One convenience store chain found that it could no longer grow by continuing to open new stores. It then changed its strategy to maximise same-store sales. To achieve that required a vast amount of external data, including the type of population that lived or worked around the store, whether there was a transient population, the buildings in the neighbourhood and the socio-demographic profile of the area. The retailer then used all this information to develop store archetypes that matched the neighbourhood data. For example, convenience stores located near pubs would sell less beer but more wine. Based on this information, the convenience store chain integrated the ticket data per store to identify the potential per category per store and which categories had the largest growth opportunities. With these insights, it was able to optimise its planograms, moving from over 30 to over 200 different set ups. To deal with space constraints, the chain used analytics to prescribe changes. Subsequently, its revenues increased 3 per cent while margins were maximised.

FROM THEORY TO VALUE

More than meets the eye The case studies above show the importance of mastering new analytic techniques to achieve much more powerful business predictions. However, they also indicate that capturing value from data deluge requires more than a good statistical model. For instance, the telecom example shows the importance of an end-to-end vision between marketing and network functions while the bank example demonstrates the importance of translating Big Data findings into new customer clusters and segments.

The case for analytic transformation Neither data nor algorithms, which can often be an open source, are the real differentiating factors for successful companies. The key ‘dynamic capability’ for competitive advantage is the ability to engage in an analytics transformation at the enterprise level to establish new data-driven routines that will create real advantage compared with peers.4 Companies who reap returns on Big Data typically undertake the following steps:

1.

They start by identifying a business problem to solve. Any application of these new techniques should start with a business problem not a curiosity. Even then, it is extremely important to spend time identifying the right question to ask to solve the problem, developing key insights, and considering how those insights can be implemented before plunging into analytics. In the banking example, it was not about predicting who would close their account but who would have a specific type of value reduction. The retailer in the case study started the process by trying to solve the problem of how to grow without opening new stores, the telecom company wanted to improve its network deployment in cities, while the insurer wanted to reduce the number of claims it received from new customers.

2.

They use the data and tools they have at hand rather than embarking on the timeconsuming and costly process of technological change. All too often, the first thought in developing a company’s advanced analytic capabilities, is to embark on a two to three-year technology journey. While this might need to happen eventually, companies do not need to wait for such a long period of time to start reaping the benefits. Simply applying new techniques to available data can deliver much more value. Again, the bank example highlights this principle. The bank used its internal data but built a model to predict customer behaviour. In the other cases, the telecom company followed its customers for three weeks to learn what they needed, the insurance company used both internal and external data, while the retailer used external data to understand better the location of each store in order to make predictions about customer behaviour.

3.

They develop a strategy for change. Embracing new techniques requires that the entire organisation aspires to do things differently. Such an effort should not be taken lightly. It should start from the top and include a vision of how the company will change and what value that will bring. In the case of the retailer, management developed a new growth strategy and then used analytics to facilitate that change. Typically, a strategy for change should lead to a clear roadmap of use cases and strict prioritisation based on value. Too often, companies have ‘1,000 flowers bloom’ of sub-scale initiatives that distract the organisation and bring limited value. At other times, the continuous flow of ideas shifts the focus from one thing to the next, neglecting implementation and hence value creation. While the world is changing too quickly to stick to one specific priority for too long (more than six months or so), there should be a disciplined yet agile process to ensure things get done. In the retail example, as soon as the first insights started to emerge, there was discussion about how to split the model further into more granular categories and how to add new variables, such as the weather. One of the risks of the data deluge is that ‘boiling the ocean’ is now more possible than ever. In this case, the retailer realised that it would never be able to influence the weather and that information would already be embedded in the geolocation of the stores. The retailer recognised that while adding additional granularity to the categories could provide more detail, it would not provide additional benefits.

4.

They make some organisational changes. Fostering a culture that embraces change is a critical part of any analytic transformation. This often requires some organisational changes such as a new department that can lead the charge. This new department (chief data officers, chief analytic officers) should be responsible for developing and overseeing the new skills and strategy for data collection and architecture. In terms of data, value comes from putting together different sources of data that already exist, scattered throughout the organisation. Keeping such data locally in the business units or functions leads to replication of data across the company (for example, compliance data in a bank versus marketing data) so companies need a central data collection point. Of course, with the use of new innovative solutions, this does not mean moving data physically but rather making the data accessible for all. The second problem is about quality. Having one single source of data does not resolve quality issues. But data quality should not be the responsibility of this new department. While they are the guardians of the data, they are not responsible for improving data. Typically, that falls to those on the front lines of data collection. In terms of skills, there is a temptation to integrate new skills directly into the business units and functions. However, some of these job profiles are quite fungible and scarce and should not be scattered throughout the organisation. Employees grow and nurture each other by working together and learning from each other in a centralised hub that provides service to the entire organisation. This is certainly true for technicians such as architects, engineers and scientists, while translators need to stay closely connected. Over time, technical skills can be deployed to some of the large units with a ‘hub and spoke’ approach, but a company needs to ensure standardisation of methodologies and technologies to promote continuous learning and avoid reinventing the wheel every time. Above all, a new department can coordinate across departments and business units to deliver results. In the telecom example, the company already had in place churn prediction models that were based mainly on usage data (how often customers called, when and to whom) and billing data. But they had not integrated other sources of readily available data, such as call centre, shopping and app logins, navigation or network quality issues. Connecting all of these data not only enabled a much more powerful model to predict customer behaviour but also a better understanding of the characteristics of each customer cluster in order to develop specific actions. This could not have occurred without many different departments working together on what would have typically been left to the marketing department to handle.

5.

They think through operational changes. Many initiatives fail due to a lack of understanding about what changes are required to current processes in order to benefit from data insights. For example, at one airport, a model revealed that delays were caused by having large planes after small planes (or vice versa) in the same passenger gateway. One solution was to group planes of the same size in the same gateway, but this did not work with flight schedules and terminals. What worked was a change in operating procedures, to make sure the person operating the gateway had information about the next plane to arrive and could ensure the gateway was ready for the type of plane in advance. This same principle is apparent in the bank case study. The bank thought carefully about how to retain customers who were 21 and younger and developed a new product designed specifically to appeal to them. In the insurance example, the insurer changed its underwriting process by asking for additional information only after it understood what additional information would be necessary.

6.

They develop their talent pool. A company needs different types of talents for analytics. In terms of talent, a company needs a number of new skills to deal with new data management, for example, data architects and data engineers, and with new analytical techniques, such as data scientists and statisticians. Despite the current shortage of these profiles in the market, they are still relatively easy to find. By contrast, a job profile that is especially difficult to find is that of ‘translator’.5 Translators are the people who know the right question to ask, the right application of the data insight and most importantly, will drive change. A company’s need for translators outnumbers technical employees, and these positions need to be filled internally. Done well, advanced analytics provides superior insights that enable true competitive advantages, for example in the insurance case above where the insurer became far more competitive after identifying potential fraud cases and reducing the number of claims. But faced with the complexity of the change and the lack of skills, some companies are leaning towards outsourcing this important function. This, however, leads to solutions that are standardised and ‘as good for you as for your competitor next door’. In other words, they are not tailored to a company’s operating procedures and hence cannot fully provide the benefits. In order for a company to develop a real competitive advantage in data analytics, it needs to develop these skills internally. Obviously, partners are needed, mainly for technology, as well as new tools, but the talent to know what to do with the insights needs to be fostered and developed within a company. For example, the telecom company in the case study had asked an external company to develop a predictive model for churn. The vendor provided an extremely high predictive model (Gini >90%) but it did not result in the amount of customer churn being reduced. When the company looked closer at the model, it found that one of the most predictive variables was whether the customer had called the retention desk within ten days of closing their account. What the external company did not realise was that given the telecom company’s internal processes, it took ten days for a customer to actually show up as ‘churned’ in the system, so their model was basically using information that the customer had already left to predict they were going to leave. Employees who know and understand how the business works are typically the only ones who can effectively turn data insights into profitgenerating actions. So, when it comes to reaping the rewards of analytics, a company’s talent pool is its greatest asset.

CONCLUSIONS AND MANAGERIAL IMPLICATIONS

The ability of new advanced analytic techniques to better predict the actions a firm can take to succeed has made Big Data far more attractive to the corporate world. The traditional view of Big Data, however, is limited. Often assumed to be some data and a few analytic ‘geeks’ delivering insights, the reality is more complex and requires an analytic transformation of the entire enterprise. Companies should first establish a checklist based on the six steps outlined above. Then start with a business problem, identify one compelling use case, prioritise based on value, identify as much data as possible, and incorporate advanced analytic techniques. Next use the insights to think carefully about how to change the existing workflow to produce benefits. Then measure those benefits. This initial test case could take three to four months and should create momentum within the organisation. Follow this immediately with a strategy and roadmap for other use cases while setting up any necessary new infrastructure, making organisational changes, and developing the required skills throughout the organisation to enable analytic transformation. A full analytic transformation can take 12–18 months, but as with any transformation, it starts with a first step: identify a pressing business problem that needs a solution. The benefits from an analytic transformation are too large to delay.

AUTHORS’ NOTE

Any errors are the authors’. We thank Nicolaus Henke for his support and insights in the development of this article.

References 1. Bughin, J. (2017) ‘Ten big lessons learned from Big Data analytics’, Applied Marketing Analytics, Vol. 2, No. 4, pp. 286–295.

2. Henke, N., Bughin, J., Chui, M., Manyika, J., Saleh, T., Wiseman, B. and Sethupathy, G. (2016) ‘The age of analytics’, available at: http://www.mckinsey.com/business-functions/mckinsey-analytics/our-insights/the-age-of-analytics-competing-in-a-data-drivenworld (accessed 9th June, 2017).

3. Wixom, B. and Ross, J. (2017) ‘How to monetize your data’, Sloan Management Review, Vol. 58, No. 3, pp. 10–13.

4. Barreto, I. (2010) ‘Dynamic capabilities: a review of past research and an agenda for the future’, Journal of Management, Vol. 36, No. 1, pp. 256–280.

5. Bughin, J. (2016) ‘Big Data, big bang’, Journal of Big Data, Vol. 3, No. 2, pp. 1–14.

#MachineLearning